Guest Post By Chris Hamilton

By any objective measure Reserve Currencies — particularly the US dollar — are dying. The question most analysts get when discussing the reality of the US and world economic/financial situations is, if things are so dire, why doesn’t it feel like it? (***see dire links below )

If all the facts stated about $6 trillion annual (GAAP basis) US budget deficits or US government total debt and obligations in excess of $90 trillion are true, why does the system still “function”??? Social Security recipients receive checks, the military is still paid, the garbage gets picked up, and stores still have stocked shelves. Life seems hectic but generally “normal”. So, is there a problem at all and if so, when and how will it go from theoretical to reality?

US

is Bankrupt: $89.5 Trillion in US Liabilities vs. $82 Trillion in

Household Net Worth & The Gap is Growing. We Now Await the Nature of

the Cramdown. – See more at:

http://charlesbiderman.com/2014/08/04/us-is-bankrupt-89-5-trillion-in-us-liabilities-vs-82-trillion-in-household-net-worth-the-gap-is-growing-we-now-await-the-nature-of-the-cramdown/#sthash.RkY8CKFZ.dpuf

US

is Bankrupt: $89.5 Trillion in US Liabilities vs. $82 Trillion in

Household Net Worth & The Gap is Growing. We Now Await the Nature of

the Cramdown. – See more at:

http://charlesbiderman.com/2014/08/04/us-is-bankrupt-89-5-trillion-in-us-liabilities-vs-82-trillion-in-household-net-worth-the-gap-is-growing-we-now-await-the-nature-of-the-cramdown/#sthash.RkY8CKFZ.dpuf

***US

is Bankrupt: $89.5 Trillion in US Liabilities vs. $82 Trillion in

Household Net Worth & The Gap is Growing. We Now Await the Nature of

the Cramdownor

***America Has Adopted The Sclerotic European / Japanese Model

or

***The Story of America’s Economic Illiteracy – Truth hidden in Plain Sight…Yet We Choose to be Blind?

Commit to about 5 to 10 minutes of reading and maybe we can have a very plausible answer.

A LITTLE BACKGROUND

Following WWII, a new monetary system for international commerce and finance was implemented. This agreement known as Bretton Woods (the location in New Jersey where the conference was held) gave the expected Allied victors the spoils and represented the World as of 1945.CHIEF FEATURES OF THE BRETTON WOODS SYSTEM:

• An obligation for each country to adopt a monetary policy that maintained the exchange rate by tying its currency to the U.S. dollar• The ability of the IMF (created by the Bretton Woods agreement along with many other current day acronyms) to bridge temporary imbalances of payments (IMF would loan money to nations in trouble with strings attached to ideally resolve these imbalances and keep the system functioning).

• Address the lack of cooperation among other countries and to prevent competitive devaluation of the currencies as well (avoid countries printing money to cheapen their exports and gain advantage in trading)

• To ensure the US did not abuse it’s privilege as the world’s de-facto currency, the US dollar would be freely convertible into gold (if the US printed an excess quantity of $’s, nations accumulating too many dollars from US trade/budget deficits could convert and retire these dollar’s into gold (gold representing a relatively fixed quantity and storage of value).

WHAT ACTUALLY TOOK PLACE:

• 1946-1959 – Growth surged while debt was flat.• Total US government obligations grew minimally from $269 billion to $285 billion. As a result the Debt to GDP ratio fell from 113% to 54%. In other words, the US essentially ran a balanced budget adding approximately $1 billion per year to national debt over 13 years, (about a third of a % annually…all while conducting the Marshall plan, the Korean War, and huge US infrastructure projects). The US was the model of global economic stability and fiscal restraint.

• 1960-1975 – Debt Doubled While GDP Grew by More Than Three Times.

• US government debt almost doubled from $285 billion to $533 billion while GDP more then tripled, from $525 billion to $1.7 trillion. In 1975 the US hit a Debt/GDP post Great Depression low of 31%. But great forces were already set in motion that would lead us to today’s trouble…including the initiation of the Great Society in ‘65 and LBJ’s four years later theft of these surplus’ meant to cover future tax shortfalls for these programs…all to hide the true cost of the Vietnam war…all under the “Unified Budget”. The US had put in motion the betrayal of Bretton Woods for national political purposes and the unfunded liability monster was borne.

• 1975-2014 – Debt Spiked 168 times, 16 times GDP Growth, 11 times Household Net Worth.

• Total US government obligations grew from $533 billion to $89.5 trillion while GDP grew 10x’s $1.7 trillion to 17 trillion and Household net worth grew 15x’s $5.4 trillion to $82 trillion. Median household income grew 3x’s from an estimated $17k to $51k annually while Real median household income barely grew 1.13x’s, from $45k to $51k annually. Bad policy decisions of 4 decades earlier went parabolic.

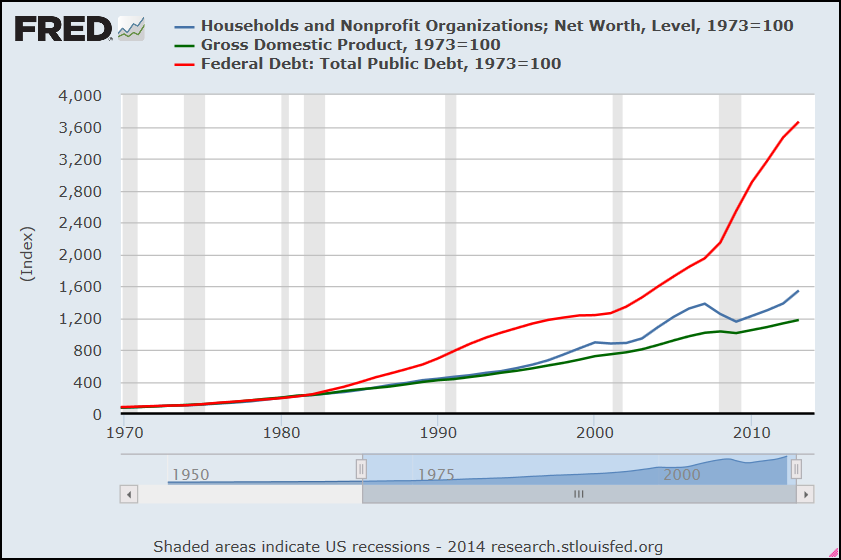

Below is a chart of GDP, Household Net Worth, and Federal Treasury Debt all indexed to 1973 to visualize the growth and relationship in each over the last four decades.

RAMIFICATIONS

• The US had roughly 19,000 tons of gold as of the end of WWII and peaked in excess of 20,000 tons by 1958…but by 1971, the redemptions by nations concerned over US deficit spending and printing had reduced the US gold holdings to just over 8,000 tons and a run on the remaining gold (the convertibility of the dollar to gold being the dollars foundation of the dollar) looked likely.• 1971 President Nixon closed the US dollars convertibility into gold…but to avoid the dollars demise, Nixon struck an agreement with Saudi Arabia (and soon after all of OPEC) that all future purchases of oil will need be conducted in US dollars (regardless the buyer or destination). In exchange, the US promised weapons and protection to these close “allies” of the US. Unfortunately, this policy rewarded some very un-democratic and very despotic leaders in the middle-East whom reaped the rewards with a tiny minority of their cohorts. These trade policies typically left the populace poor and seething with anger at the US for supporting kings and dictators who ruled in complete contradiction to US founding principles and the best interests of the citizens of these nations.

• Ultimately, this petro-dollar agreement allowed the US to run very large trade and budget deficits and export the excess dollars worldwide (through our trade/budget deficits) that would have otherwise created significant inflation within the United States.

• This Petro-dollar agreement compelled by force of necessity a gigantic supply of dollars to be accumulated by foreign nations worldwide.

• In fact, the estimate is that there are more than 4x’s the supply of all money in the US ($2.8 trillion, M1**) held abroad ($12+ trillion). This includes nearly $6 trillion in foreign held US Treasury’s, $6+ trillion in formal Reserves, and the Federal Reserve estimated that 55% to 70% (and potentially in excess of 100% of M1) of all US currency was held abroad and increasing as of 2012*. As an aside, 80% of all US currency is in $100 bills and the vast majority of these reside overseas, but foreigners also hold lesser amounts in $50’s and $20’s. These formal and informal dollar and US Treasury bond reserves held by foreign nations allow trade in oil and other de-facto dollar denominated commodities (legal and illicit).

Crisis and Calm: Demand for U.S. Currency at Home and Abroad from the Fall of the Berlin Wall to 2011

**M1 = the supply of money measured by all physical money, checking accounts, and liquid cash like money within the US economy

BRETTON WOODS, THE DOLLAR, & THE “BRICS”

But global power has shifted a bit since 1945 and the US has balked on its Bretton Woods pledges, the Middle-East teams with “radicals” and “revolutionaries”, and now the BRICS (Brazil, Russia, India, China, South Africa) are on a path to de-emphasize dollar usage in favor of localized, decentralized currencies in trade. The US leans on the privilege of the dollar (established @ Bretton Woods) to maintain its lifestyle via massive $6 trillion annual (GAAP basis) deficit spending…but the dollars global dominance wanes more every day while America increasingly leans on this rickety crutch.Today, the BRICS account for about 25 per cent of global GDP, 35 per cent of total international reserves (with China at over $4 trillion), 25 per cent of total land area and around 42 per cent of the world’s population…and BRICS affiliated nations increase these numbers significantly more.

However, despite their economic weight, the BRICS’ representation, voting power, participation in management and staff in the Bretton Woods institutions (International Monetary Fund, World Bank, World Trade Organization, and International Finance Corporation) and others like the Bank of International Settlement, displays a major deficit of ‘voice’ and influence.

As of July, the BRICS nations formally agreed on a BRICS bank funded w/ $100 billion to rival the influence and power of the IMF. This money is to be lent to nations in need, as an alternative to the IMF (typically with US directed strings attached). China, Brazil, Russia, and so many more are moving away from clearing their trade in dollars and instead utilizing the Yuan, the Real, the Ruble, etc. Please note that Russia and Saudi Arabia are now the largest exporters of oil – and at least Russia is moving rapidly to settle in anything but the dollar…and the troubles in Saudi Arabia, Iran, Iraq, Libya, Syria, Ukraine, etc. are all symptomatic of this conflict for which currency(s) will be used to settle trade.

China is organizing itself and its trade partners in at least 24 separate agreements to transact in the Yuan rather than the dollar. As of 2009, less than 1% of China’s global trade was settled in Yuan but by mid-2013, 17% of Chinese trade was being cleared in Yuan…almost entirely at the expense of the dollar. And the trend and structure to allow far more has only accelerated throughout the BRICS.

ENOUGH – WHAT’S THE ANSWER ALREADY?

It should be very clear where this trend is going and the implications to the United States – the perennially optimistic Congressional Budget Office and like prognosticators have acknowledged the US will soon need to run even larger budget deficits in excess of $1 trillion (and that’s assuming all goes well) due to large debt loads, growing social programs, and large unfunded liabilities. Of course the situation will only get worse because:• We consistently spend more cash than we take in as revenue but due to Cash-Based accounting the true nature of the deficit spending is concealed.

• We continue adding new participants to existing entitlement programs increasing present and future unfunded liabilities…while the tax payers per social program recipient is expected to fall from 4 to 2 per recipient within a decade.

• We add new entitlement programs (i.e. the Prescription Drug Act in 2003 and the Affordable Care Act in 2010) absent funding therefore increasing our future liabilities.

• We incur interest expense each year on our Federal Obligation; real interest on our debt held by the public (included in item (a) above), virtual interest on our intra-governmental borrowings, and virtual interest on the present value of our unfunded liabilities).

All this will necessitate the world accept and utilize ever more dollars. HOWEVER, the existing dollar-centric system is not in the favor of most of the new powers of the world…and they are rapidly moving to reduce their dependence on the dollar…just as the US will need foreigners to embrace it more than ever. Rock meet hard place.

If $12+ trillion (plus the continuing growth in available dollars) is no longer needed as reserves for international settlement – where does that money go? Well, a relatively small reduction in dollar trade replaced by Yuan, Ruble, Real, etc. (say 5%-10% over a period, say 2014) would free up $600 billion to $1.2 trillion to move where dollars are still readily accepted…the US of A. Typically, these dollars would be levered up (say conservatively 5x’s)…and voila, $3 trillion to $6 trillion of purchasing power is introduced to America in 2014.

Things like stocks, bonds, and Real Estate would be very positively pushed higher and higher (rents, insurance, etc. would also be unwelcomingly pushed higher as wages remain flat due to structural unemployment issues…in other words, asset owners are rewarded, wage earners are punished). The Federal Reserve’s Z1 Household Survey for 2014 would be similar to 2013’s 11+% increase in US assets by $9.5 trillion ($84.5 trillion (’12) to $94 trillion (’13))…all while household liabilities (mortgages, all loans, etc.) barely increased ($140 billion) and wages remained flat.

But let’s say in 2015 the pace of BRICS non-dollar trade continues expanding and international settlement in non-dollars grows by 10% to 20%…and 10% to 20% of dollars are no longer needed as reserves to buy oil, wheat, finance trade, etc. etc. This is about $1.2 trillion to $2.4 trillion formerly held reserves cleared to go looking for their home…the US. $1.2 trillion to $2.4 trillion levered again very conservatively @ 5x’s (or 20% cash down) is $6 trillion to $12 trillion in “hot” money looking for assets.

With just a fraction of all the inflation the US exported over the ’71-present period coming home…this creates what amounts to a hyper-monetary dollar overdose in America. Foreign holders of US money chasing assets in America where dollars are readily accepted. And of course, once these things start, they create a momentum of their own and eventually a likely counter by the administration to freeze out these dollars and the likely panic this ensues both domestically and internationally.

IMPLICATIONS

The minority of Americans with assets see their value rise but the majority will get much poorer…those dependent on wages and social programs (generally younger, with families, retirees living on SS, etc.) absent assets are made dramatically poorer (wages stagnant while costs rise…rent, food, insurance, school, fuel, etc.). The economy suffers as consumers lose ground and inequality runs rampant. How it plays out from there is impossible to know as supply and demand implications are met with 2nd derivative government reactions and on and on and on. Beyond that, it’s all just plain guesses with little historical precedence to guide us.Of course there are many steps and actions that could be taken to acknowledge our challenges and collectively address them through shared sacrifice and a long term restructuring of our economy. But the 4+ decade trend of fraudulent accounting, financialization, and, well, like a hundred other trends that need be reversed seem unlikely to be voluntarily addressed. Prepare for the solution to be involuntarily applied in a time and manner not of our choosing.

No comments:

Post a Comment