When did our democracy die? When did it irrevocably transform itself into a lifeless farce and absurd political theater? When did the press, labor, universities and the Democratic Party—which once made piecemeal and incremental reform possible—wither and atrophy? When did reform through electoral politics become a form of magical thinking? When did the dead hand of the corporate state become unassailable?

The body politic was mortally wounded during the long, slow strangulation of ideas and priorities during the Red Scare and the Cold War. Its bastard child, the war on terror, inherited the iconography and language of permanent war and fear. The battle against internal and external enemies became the excuse to funnel trillions in taxpayer funds and government resources to the war industry, curtail civil liberties and abandon social welfare. Skeptics, critics and dissenters were ridiculed and ignored. The FBI, Homeland Security and the CIA enforced ideological conformity. Debate over the expansion of empire became taboo. Secrecy, the anointing of specialized elites to run our affairs and the steady intrusion of the state into the private lives of citizens conditioned us to totalitarian practices. Sheldon Wolin points out in “Democracy Incorporated” that this configuration of corporate power, which he calls “inverted totalitarianism,” is not like “Mein Kampf” or “The Communist Manifesto,” the result of a premeditated plot. It grew, Wolin writes, from “a set of effects produced by actions or practices undertaken in ignorance of their lasting consequences.”

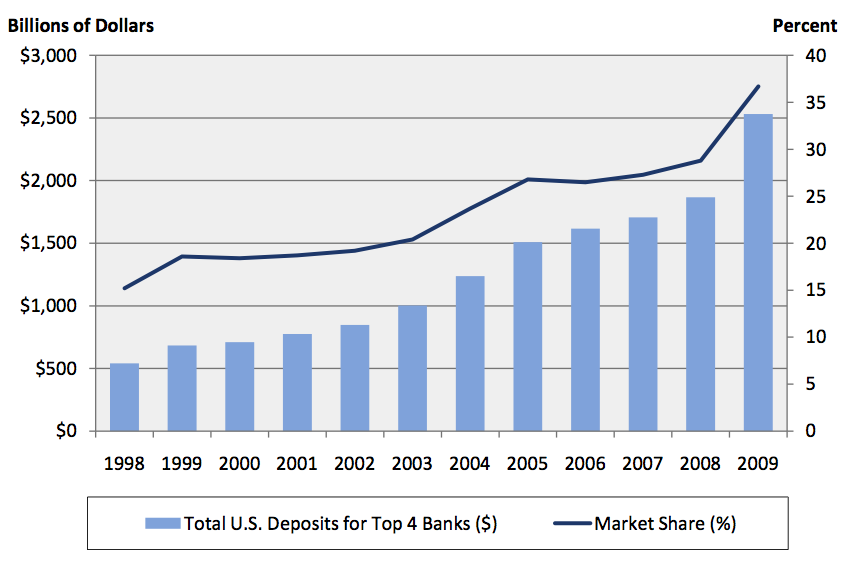

Corporate capitalism—because it was trumpeted throughout the Cold War as a bulwark against communism—expanded with fewer and fewer government regulations and legal impediments. Capitalism was seen as an unalloyed good. It was not required to be socially responsible. Any impediment to its growth, whether in the form of trust-busting, union activity or regulation, was condemned as a step toward socialism and capitulation. Every corporation is a despotic fiefdom, a mini-dictatorship. And by the end Wal-Mart, Exxon Mobil and Goldman Sachs had grafted their totalitarian structures onto the state.

The Cold War also bequeathed to us the species of the neoliberal. The neoliberal enthusiastically embraces “national security” as the highest good. The neoliberal—composed of the gullible and cynical careerists—parrots back the mantra of endless war and corporate capitalism as an inevitable form of human progress. Globalization, the neoliberal assures us, is the route to a worldwide utopia. Empire and war are vehicles for lofty human values. Greg Mortenson, the disgraced author of “Three Cups of Tea,” tapped into this formula. The deaths of hundreds of thousands of innocents in Iraq or Afghanistan are ignored or dismissed as the cost of progress. We are bringing democracy to Iraq, liberating the women of Afghanistan, defying the evil clerics in Iran, ridding the world of terrorists and protecting Israel. Those who oppose us do not have legitimate grievances. They need to be educated. It is a fantasy. But to name our own evil is to be banished.

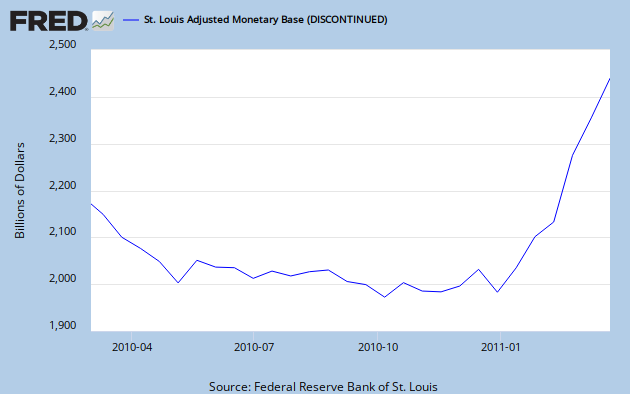

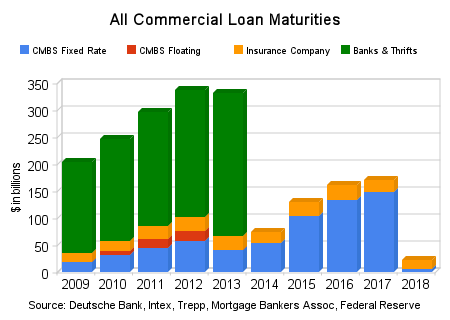

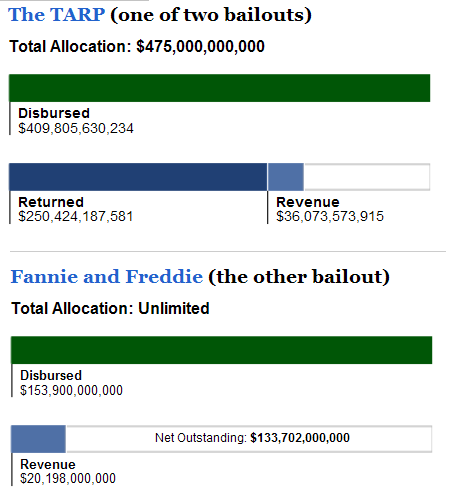

We continue to talk about personalities—Ronald Reagan, Bill Clinton, George W. Bush and Barack Obama—although the heads of state or elected officials in Congress have become largely irrelevant. Lobbyists write the bills. Lobbyists get them passed. Lobbyists make sure you get the money to be elected. And lobbyists employ you when you get out of office. Those who hold actual power are the tiny elite who manage the corporations. Jacob S. Hacker and Paul Pierson, in their book “Winner-Take-All Politics,” point out that the share of national income of the top 0.1 percent of Americans since 1974 has grown from 2.7 to 12.3 percent. One in six American workers may be without a job. Some 40 million Americans may live in poverty, with tens of millions more living in a category called “near poverty.” Six million people may be forced from their homes because of foreclosures and bank repossessions. But while the masses suffer, Goldman Sachs, one of the financial firms most responsible for the evaporation of $17 trillion in wages, savings and wealth of small investors and shareholders, is giddily handing out $17.5 billion in compensation to its managers, including $12.6 million to its CEO, Lloyd Blankfein.

The massive redistribution of wealth, as Hacker and Pierson write, happened because lawmakers and public officials were, in essence, hired to permit it to happen. It was not a conspiracy. The process was transparent. It did not require the formation of a new political party or movement. It was the result of inertia by our political and intellectual class, which in the face of expanding corporate power found it personally profitable to facilitate it or look the other way. The armies of lobbyists, who write the legislation, bankroll political campaigns and disseminate propaganda, have been able to short-circuit the electorate. Hacker and Pierson pinpoint the administration of Jimmy Carter as the start of our descent, but I think it began long before with Woodrow Wilson, the ideology of permanent war and the capacity by public relations to manufacture consent. Empires die over such long stretches of time that the exact moment when terminal decline becomes irreversible is probably impossible to document. That we are at the end, however, is beyond dispute.

The rhetoric of the Democratic Party and the neoliberals sustains the illusion of participatory democracy. The Democrats and their liberal apologists offer minor palliatives and a feel-your-pain language to mask the cruelty and goals of the corporate state. The reconfiguration of American society into a form of neofeudalism will be cemented into place whether it is delivered by Democrats, who are pushing us there at 60 miles an hour, or Republicans, who are barreling toward it at 100 miles an hour. Wolin writes, “By fostering an illusion among the powerless classes” that it can make their interests a priority, the Democratic Party “pacifies and thereby defines the style of an opposition party in an inverted totalitarian system.” The Democrats are always able to offer up a least-worst alternative while, in fact, doing little or nothing to thwart the march toward corporate collectivism.

The systems of information, owned or dominated by corporations, keep the public entranced with celebrity meltdowns, gossip, trivia and entertainment. There are no national news or intellectual forums for genuine political discussion and debate. The talking heads on Fox or MSNBC or CNN spin and riff on the same inane statements by Sarah Palin or Donald Trump. They give us lavish updates on the foibles of a Mel Gibson or Charlie Sheen. And they provide venues for the powerful to speak directly to the masses. It is burlesque.

It is not that the public does not want a good health care system, programs that provide employment, quality public education or an end to Wall Street’s looting of the U.S. Treasury. Most polls suggest Americans do. But it has become impossible for most citizens to find out what is happening in the centers of power. Television news celebrities dutifully present two opposing sides to every issue, although each side is usually lying. The viewer can believe whatever he or she wants to believe. Nothing is actually elucidated or explained. The sound bites by Republicans or Democrats are accepted at face value. And once the television lights are turned off, the politicians go back to the business of serving business.

We live in a fragmented society. We are ignorant of what is being done to us. We are diverted by the absurd and political theater. We are afraid of terrorism, of losing our job and of carrying out acts of dissent. We are politically demobilized and paralyzed. We do not question the state religion of patriotic virtue, the war on terror or the military and security state. We are herded like sheep through airports by Homeland Security and, once we get through the metal detectors and body scanners, spontaneously applaud our men and women in uniform. As we become more insecure and afraid, we become more anxious. We are driven by fiercer and fiercer competition. We yearn for stability and protection. This is the genius of all systems of totalitarianism. The citizen’s highest hope finally becomes to be secure and left alone.

Human history, rather than a chronicle of freedom and democracy, is characterized by ruthless domination. Our elites have done what all elites do. They have found sophisticated mechanisms to thwart popular aspirations, disenfranchise the working and increasingly the middle class, keep us passive and make us serve their interests. The brief democratic opening in our society in the early 20th century, made possible by radical movements, unions and a vigorous press, has again been shut tight. We were mesmerized by political charades, cheap consumerism and virtual hallucinations as we were ruthlessly stripped of power.

The game is over. We lost. The corporate state will continue its inexorable advance until two-thirds of the nation is locked into a desperate, permanent underclass. Most Americans will struggle to make a living while the Blankfeins and our political elites wallow in the decadence and greed of the Forbidden City and Versailles. These elites do not have a vision. They know only one word—more. They will continue to exploit the nation, the global economy and the ecosystem. And they will use their money to hide in gated compounds when it all implodes. Do not expect them to take care of us when it starts to unravel. We will have to take care of ourselves. We will have to create small, monastic communities where we can sustain and feed ourselves. It will be up to us to keep alive the intellectual, moral and culture values the corporate state has attempted to snuff out. It is either that or become drones and serfs in a global, corporate dystopia. It is not much of a choice. But at least we still have one.

Original Article